On this information we will be able to be taking a look at one of the best Cryptocurrency Tax Software in the marketplace as of late. In case you are on the lookout for a very easy approach to report your crypto taxes legally, we’ll display you which of them instrument is simple to use come tax time.

CryptoTrader.Tax

Fashionable crypto tax software with computerized shape technology.

CoinTracking

Lengthy-running crypto tax software with complete global enhance.

Koinly

Easy software with simple file technology and interface.

ZenLedger

Smartly rounded tax software with on-demand customer support.

We will be able to move over:

- 9 other Crypto Tax Software to be had to use as of late

- The important thing options in every instrument

- Pricing of every software

- What precisely Crypto Tax Software is and how they paintings

This information shall be nice for holders of cryptocurrency and in addition those who do unload some investments over the yr. We’ll display you the best tactics to declare crypto when tax season rolls round.

Best Crypto Tax Software to Use

Our alternatives for the best crypto tax instrument are:

- CryptoTrader.Tax

- CoinTracking

- Koinly

- ZenLedger

- TokenTax

- Accointing

- BearTax

- CryptoTax Calculator

- TaxBit

Subsequent, we’ll move over every software in additional element!

CryptoTrader.Tax

Best Crypto Tax Software in 2022

CryptoTrader.Tax is likely one of the hottest crypto tax gear to be had as of late. It has complete global enhance for tax laws all over the world. CryptoTrader.Tax turbines a large number of other studies that you may want, together with audit trails, IRS Shape 8949, source of revenue file, tax loss harvesting file, and extra.

CryptoTrader is really easy to use. You import your crypto historical past out of your alternate of selection and the instrument will mechanically determine honest marketplace worth of every coin in accordance with ancient knowledge that it pulls by itself finish. As soon as your historical past is imported, your tax file will also be generated with the press of a button.

CryptoTrader is partnered with each TurboTax and TaxAct this means that you’ll be able to simply import your CryptoTrader file proper into the tax program and it’ll autofill your data. CryptoTrader can be utilized across the world and allows you to generate your studies in any foreign money of your selection.

Supported Exchanges and Wallets

CryptoTrader has integration from each primary alternate and pockets together with:

- Coinbase and Coinbase Professional

- Binance

- Uniswap

- Kraken

- Gemini

- Exodux

- BlockFi

- Crypto.com

- KuCoin

- Celcius

- Ledger

- Metamask

- Trezor

- FTX

- CoinMetro

- ProBit

Key Options

- Mechanically generates you an IRS Shape 8949 for attaching to your tax go back.

- Direct import functions with TurboTax.

- Tax loss harvesting laws to let you offset and scale back your capital positive aspects.

Pricing

CryptoTrader has 4 other pricing tiers relying in your number of trades during the yr.

Hobbyist – $49 USD

Day Dealer – $99 USD

Top Quantity – $199 USD

Limitless – $299 USD

Use the code CRYPTOTAX10 at take a look at to obtain 10% off your plan!

Click on right here to take a look at CryptoTrader.Tax as of late.

CoinTracking

Best World Improve

CoinTracking is an all In a single software that used to be one of the vital first Crypto Tax instrument gear. It’s an multi function software with complete research, computerized industry uploading, and complicated tax declaration. CoinTracking has enhance for 13 other tax strategies similar to first-in-first-out, last-in-first-out, moderate charge, and others.

CoinTracking provides simple transaction import from over 110 other crypto exchanges and permits you to export information in many alternative codecs similar to PDF, Excel and CSV. CoinTracking additionally has crypto tax regulations for over 100 other nations inbuilt in order that it’s custom designed precisely for you.

CoinTracking supplies tax studies for 100+ counties and in addition supplies you historical past for all 18,177 crypto cash. You’ll even import data from out of date exchanges, wallets, and crypto cash. You’ll all the time see the most recent costs for each coin and in addition clear out cash by means of quantity of trades and extra!

Supported Exchanges and Wallets

CoinTracking has complete integrations with loads of wallets and exchanges together with:

- ACX

- Bison

- Bitpanda

- Coinbase and Coinbase Professional

- Celsius Community

- CoinSpot

- Gemini

- HitBTC

- HotBit

- Huobi

- KCoin

- Tidex

- Zerion

- Exodus

- Ledger

Key Options

- Just right worth – 200 transactions for free!

- Complete API enhance and coin uploading.

- Crypto tax monitoring for over 18,000 cash.

- 13 years of ancient knowledge to pull traits and data from.

Pricing

CoinTracking recently has 4 other pricing tiers to be had.

Unfastened

- To be had for brand new crypto traders and up to 200 transactions

- Very restricted on the subject of paperwork and gear to be had

Professional – $10.99 USD per thirty days, billed every year

- Up to 3,500 transactions

- 20 MB in step with CSV report

- Get entry to to complicated gear and API get entry to to your portfolio

Professional – Begins at $16.99 USD per thirty days, billed every year

- Other choices of 20,000 / 50,000 / 100,000 transactions and the fee will increase with every

- Complete integration with 10 auto imports for every coin and limitless handbook imports

Limitless – $54.99 USD per thirty days, billed every year

- Limitless transactions

- Complete integration and get entry to to all complicated gear

- Precedence calculations and buyer enhance

If you happen to use our associate hyperlink beneath, you get 10% off in your plan!

Click on right here to view CoinTracking.

Koinly

Most simple Crypto Tax Software

Koinly is helping you generate your crypto tax abstract in lower than 20 mins. It simplifes the method by means of connecting immediately to the preferred crypto exchanges and producing your buying and selling file. You do not want to manually export CSV information and different data.

Koinly has a slick, simple to use dashboard. It permits you to simply import your transaction historical past from over 350 exchanges. You additionally don’t have to concern about going backward and forward between a couple of wallets or accounts you’ll have. Koinly will stay your entire buying and selling process in a single dashboard display screen.

Koinly has a inbuilt gadget this is intended to to find any issues along with your transactions and let you fix them. It’ll mechanically skip over reproduction transactions and also will permit you to know in case your transaction historical past is skewed or lacking data.

Koinly is to be had in many alternative counties internationally and can generate your capital positive aspects file in accordance with your native tax regulation.

Supported Exchanges and Wallets

Koinly has integration with the next wallets and exchanges (plus extra now not indexed!):

- Binance

- Bittrex

- Coinbase and Coinbase Professional

- Cobinhood

- Luxor

- Phemex

- Bitpanda

- CoinJar

- Celcius

- Airswap

- Metamask

- Phantom

- Divi

- Ledger

Key Options

- Connects immediately to your crypto exchanges for are living tax reporting.

- View your capital positive aspects or capital losses whener you need for free.

- Integrates with TurboTax and mechanically generates your Shape 8949.

Pricing

Koinly has 4 other pricing tiers relying on what you might be on the lookout for.

Unfastened – $0

- 10,000 transactions

- No get entry to to sure tax paperwork (Shape 8949 and Time table D)

- No get entry to to global tax studies

- No complete audit file

Beginner – $49 USD/tax yr

- 100 transactions

- Complete get entry to to the whole lot apart from devoted Electronic mail Improve

Hodler – $99 USD/tax yr

- 1,000 transactions

- Complete get entry to to the whole lot apart from devoted Electronic mail Improve

Dealer – $179 USD/tax yr

- 10,000+ transactions

- Complete get entry to to all options

- Complete devoted e-mail enhance

Click on right here to take a look at Koinly.

ZenLedger

Best Tax Guidelines and Tips

ZenLedger guarantees to simplify crypto taxes for you at tax time. All your transactions are summarized right into a unified spreadsheet.

ZenLedger has a Tax-Loss software built-in into the instrument which is able to analyze your buying and selling historical past and come up with tips on tactics to save on taxes prior to the tax cut-off date every yr.

As soon as your transaction historical past is imported, ZenLedger will mechanically calculate your capital positive aspects and losses and bring together all of it onto a Time table D shape. That is wanted every tax yr and you’ll be able to simply print off when submitting your individual taxes, or supply it to your accountant.

ZenLedger is simplest to be had to use in the US at this time, however they do have plans sooner or later to amplify into the Canadian tax marketplace.

Supported Exchanges and Wallets

ZenLedger has direct integration with over 400 exchanges and 40 blockchains together with:

- Money App

- CoinSwitch

- Coinbase and Coinbase Professional

- Bitstamp

- Binance

- Uniswap

- Zapper

- Exodus

- Ledger

- Trezor

- MyEtherWallet

Key Options

- Complete tax-loss harvesting software that mechanically provides you with tax saving alternatives

- Direct integration with TurboTax

- On-demand customer support 7 days per week

Pricing

ZenLedger has 4 pricing tiers to be had.

Unfastened – $0

- Unfastened instrument to be had that any one who does 25 transactions or much less in a yr

- No get entry to to DeFi, Staking or NFTs – only crypto transactions

Starter – $49 USD/yr

- Up to 100 transactions in step with yr

- No get entry to to DeFi, Staking or NFTs

Top class – $149 USD/yr

- Up to $5,000 transactions in step with yr

- Complete get entry to to all options

Government – $399 USD/yr

- Limitless transactions in step with yr

- Complete get entry to to all options

Click on right here to take a look at ZenLedger.

TokenTax

Best Crypto Change Improve

TokenTax is a custom-built crypto tax instrument platform. It totally the whole lot for you together with tax calculations, capital positive aspects calculations, and automated tax shape technology.

Similar to Koinly above, TokenTax attach to each crypto alternate in order that you don’t have to manually export your knowledge. TokenTax will totally import your entire transaction knowledge into the instrument and generate tax paperwork in mins.

TokenTax has what they name a “Tax Loss Harvesting” dashboard the place they’re going to run your knowledge and display you precisely the place unrealized positive aspects and losses are. They are going to additionally give tips on promoting off sure belongings so as to perhaps scale back taxable positive aspects.

TokenTax helps each unmarried nation and foreign money this means that it’ll generate your studies in any foreign money of your selection.

Supported Exchanges and Wallets

They’ve complete integration with each unmarried crypto alternate so record some of the distinctive ones beneath:

- Abra

- Ampleforth

- Binance and Binance.US

- Bitpay

- Blockfolio

- Money App

- Coinbase and Coinbase Professional

- Crypto.com

- Compound

- Exodus

Key Options

- Connects to just about each crypto alternate, much more difficult to understand ones.

- Accommodates an in depth tax loss harvesting dashboard.

- Helps global tax regulations in Zurich, UK, Canada, Australia, Japan, Sweden, South Africa, and extra.

Pricing

TokenTax has 4 other pricing tiers.

Elementary – $65 USD/tax yr

- Best to be had for Coinbase and Coinbase Professional

- Up to 500 transactions

Top class – $199 USD/tax yr

- Improve for each alternate

- Up to 5,000 transactions

- Tax loss harvesting dashboard integrated

Professional – $799 USD/tax yr

- Up to 20,000 transactions

- All exchanges supported together with DeFi and NFT integration

- Limitless revisions and are living chat enhance

VIP – $3,500 USD/tax yr

- Up to 30,000 transactions

- Supplies two 30 minute classes with a tax professional

- Complete enhance and IRS audit help

Click on right here to view TokenTax.

Accointing

Best Accounting Insights

Accointing is a crypto tax software that permits you to monitor your portfolio and file your taxes all on your own. Throughout the software are a host of accounting insights which can be adapted to you. As neatly, Accointing can attach you immediately with tax advisors who assist you to report your taxes.

Accointing simply imports your entire crypto transaction historical past and it simplest takes 5 clicks to generate your individual tax file on your nation. Additionally they be offering each a cell app and desktop crypto tracker to analyze your crypto transactions.

Incorporated within the Accointing crypto tax instrument dashboard is an general crypto marketplace evaluation during which you’ll be able to set indicators for sure cash. It’ll additionally advise you of any trending crypto tokens.

Supported Exchanges and Wallets

Accointing is built-in with many exchanges, wallets and blockchains similar to:

- Airbitz

- Atomic Pockets

- Binance

- Bitcoin Money & Bitcoin

- Bitpanda

- Coinbase and Coinbase Professional

- Sprint

- Deribit

- Freewallet

- Exodus

Key Options

- Has the Accointing Crypto Tax Consultant Community (ACTAN) to let you report your taxes.

- Will provide you with precious insights, marketplace traits, and pointers for submitting your taxes with cryptocurrency

- Has a desktop and a cell app.

Pricing

Accointing has 3 pricing tiers to be had.

Hobbyist – $79 USD/tax yr

- Up to 500 transactions

- Complete get entry to to all options

Dealer – $199 USD/tax yr

- Up to 5,000 transactions

- Complete get entry to to all options

Professional – $299 USD/tax yr

- Up to 50,000 transactions

- Complete get entry to to all options

Click on right here to view Accointing.

BearTax

Best Crypto Tax Software For Top Quantity Investors

BearTax is a sturdy software for prime quantity investors that may crunch thousands and thousands of transactions in step with minute. We truly just like the interface, which highlights your trades and cost-basis on your entire transactions.

Just like the opposite crypto tax instrument, BearTax will simply import your entire crypto transactions into one slick dashboard. BearTax will stay a historical past of your entire trades in addition to stay a historical past of the cost-basis in an effort to see fluctuation during the yr.

BearTax has enhance thru US, Canada, Australia and India. While you join an account, you’ll be able to make a selection your nation and your entire nations tax laws gets auto-assigned to your studies.

BearTax will supply a complete audit path report for those who get decided on by means of your native earnings company to be audited. This report offers you a complete file of your price range so that you don’t have to concern. BearTax is built-in with over 50 exchanges by way of API and CSV and in case your alternate isn’t supported, they’re going to additionally permit you to do tradition imports.

Supported Exchanges

BearTax has integration with:

- Binance

- Coinbase and Coinbase Professional

- Gemini

- KuCoin

- Kraken

- Coinsquare

- Circle

- Crypto.com

- CoinEx

Key Options

- Has a sensible matching set of rules which flags transactions that harm you in your taxes.

- Autogenerates your entire tax paperwork.

- Has privateness classes to be had with skilled accountants all over the world.

Pricing

BearTax has 4 other pricing tiers to be had.

Elementary – $10 USD/tax yr

- Up to 20 transactions

- Limitless exchanges

Intermediate – $45 USD/tax yr

- Up to 200 transactions

- Limitless exchanges and e-mail enhance

Professional – $85 USD/tax yr

- Up to 1,000 transactions

- Limitless exchanges

- Chat enhance

- A couple of alternate accounts

Skilled – $200 USD/tax yr

- Limitless transactions and exchanges

- Precedence 24/7 chat enhance

- Customized report imports to be had

Click on right here to view BearTax.

CryptoTax Calculator

Best Tax Calculator for NFTs, DeFi & DEX Buying and selling

CryptoTax Calculator simplifies your paintings so long as you are living in considered one of its 21 supported tax jurisdictions. The software truly makes a speciality of its enhance for NFTs, DeFi, and DEX buying and selling.

At the side of uploading your elementary crypto transactions, CryptoTax Calculator additionally permits for extra complicated tax situations similar to DeFi loans, crypto staking rewards, fuel charges and extra. They’re totally built-in with DeFi merchandise similar to UniSwap, PancakeSwap and SushiSwap.

CryptoTax Calculator supplies a breakdown of every calculation carried out on your taxes in an effort to perceive precisely what has been carried out. CryptoTax Calculator is supported in Australia, Canada, UK, Zurich, South Africa, Austria, Belgium, Germany, Spain, Finland, France, Greece, Eire, Italy, Japan, Netherlands, Norway, New Zealand, Portugal, Sweden and Singapore.

Supported Exchanges

They’re totally built-in with loads of exchanges and wallets similar to:

- BitMEX

- Crypto.com

- KuCoin

Coinbase and Coinbase Professional - FTX

- HitBTC

- Huobi

- Ledger

- Trezor

Key Options

- Supplies a very easy breakdown in an effort to perceive precisely what has been carried out.

- Entire enhance for DeFi and DEX buying and selling.

- You’ll calculate your crypto taxes way back to 2013.

Pricing

CryptoTax Calculator has 4 other pricing tiers to be had.

Rookie – $49 USD/yr

- 100 transactions

- Limitless integrations

Hobbyist – $99 USD/yr

- 1,000 transactions

- Limitless integrations

Investor – $189 USD/yr

- 10,000 transactions

- Limitless integrations

Dealer – $299 USD/yr

- 100,000 transactions

- Limitless integrations

Click on right here to view CryptoTax Calculator.

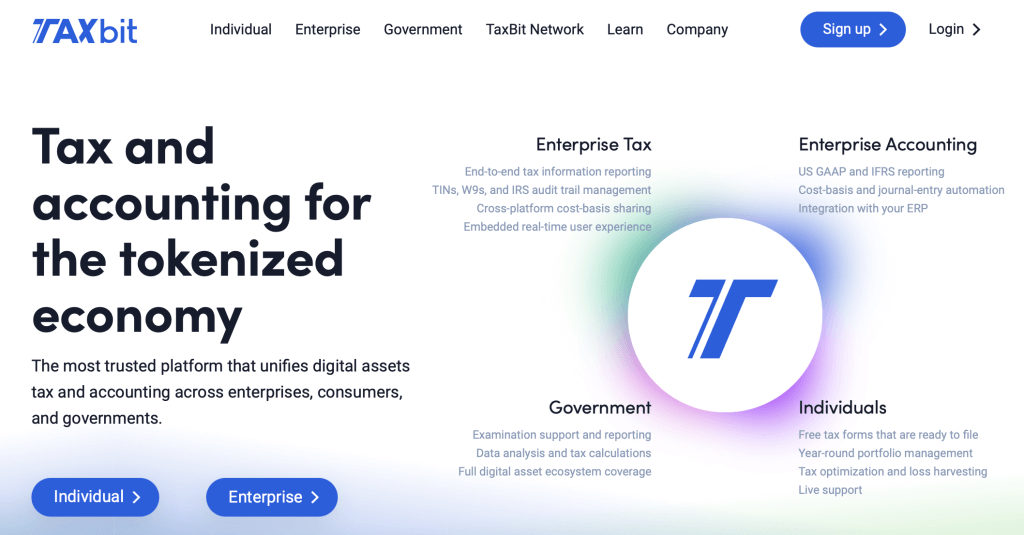

TaxBit

Best Pre-Transaction Tax Research Software

TaxBit is a crypto tax instrument created by means of a group of CPAs, all with a love for cryptocurrency. This guarantees that your entire best pursuits are being taken care of when it comes to tax season. TaxBit permits you to download your entire finished tax paperwork for free.

This software has API integration with all primary crypto exchanges. It’s been constructed from the bottom up by means of CPAs who labored immediately with native regulatory businesses.

With the upper up plans, TaxBit may even display you the tax have an effect on of every industry prior to you if truth be told make it. They are going to give suggestions so that you’re getting probably the most from your belongings when it comes to submitting your taxes. You’ll additionally track your investments always and notice its efficiency on returns and a lot more.

Supported Exchanges and Wallets

TaxBit is built-in with loads of exchanges and wallets together with:

- PayPal

- Binance

- UniSwap

- Celcius

- SoFi

- Nifty Gateway

- Coinbase and Coinbase Professional

- Okcoin

- Blockchain.com

Key Options

- Presentations you pro-active worth calculations prior to you make any trades.

- Automated tax shape technology.

- Supported by means of a group of actual CPAs and tax execs.

Pricing

TaxBit recently has 4 pricing tiers to be had.

Community – Unfastened

- Limitless transactions and hooked up pockets addresses

- DeFi and NFT Tax engine integrated

- Integration with 500+ platforms

Elementary – $50 USD/yr

- Limitless transactions

- Are living internet chat enhance

- Supplies ancient tax paperwork and current-year tax paperwork for different platforms

Plus+ – $175 USD/yr

- Limitless transactions

- Are living internet chat enhance

- Tax optimization and Tax-Loss Harvesting software integrated

- NFT Suite integrated

Professional – $500 USD/yr

- Limitless transactions

- Devoted concierge and are living internet chat enhance

- Complete integration and all paperwork to be had

- CPA Assessment and IRS Audit Improve integrated

Click on right here to view TaxBit.

What’s Crypto Tax Software

The aim of Crypto Tax Software is to simply permit you to attach your pockets or alternate in an effort to give you the vital paperwork when submitting taxes. This instrument will import your belongings, auto-fill the proper paperwork and extra. A few of them may also follow your nations crypto tax regulations to the quantities simply to make certain the whole lot is completed accurately.

As you’ll be able to see from above, there are slightly a couple of other crypto tax instrument’s to be had to use when it comes time to submitting your taxes. A large number of other people may now not notice that you’ve got to declare your cryptocurrency at tax time. In case you are any person that completes a large number of transactions during the yr, you’ll want to report this along with your taxes.

Tell us when you have used any of the above Crypto Tax Software and how it labored for you!